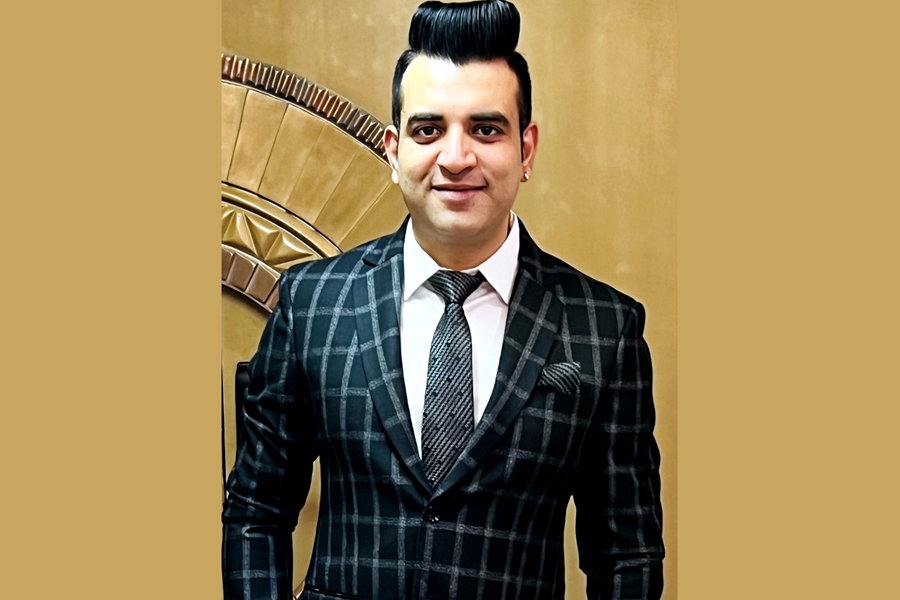

“Reforming stable economic criteria in the real estate sector is a steady process into which the government plays a vital role. In the year 2009, there was a gradual drop of the statistics in real estate shares in the share market which is now recovering and rising from the past few years.” said, Sachin Arora, Director at Investors Clinic Infratech Private Limited.

The real estate industry is one of the major sectors that play a vital role in the economical ratio of the country. The realty sector can determine the dynamic change that seems to happen and has been seen. It has been observed that for a country, most of the investors for residential sectors are domestic but there is an absolute incline in the commercial beneficiary sector from the past years. But to make up for this industry, there are certain factors that play an immense role. This can be the geographical, feasible, political and domestic as well as foreign investors.

The geographical possibilities are the infrastructure, nearby USPs, connectivity and also the average FAR of the particular region that attracts buyers.

The feasibility of a property is how it becomes a surplus to its buyer. Let’s say, a person X wants to buy a home for his self-use and Y wants to buy a home for commercial purposes (for lending it over rent for other’s personal use) as he already has his own desired residence, then the housing is feasible for X but not a boom for Y. That is because Y can invest in real commercials which fulfill his requirement as an asset as well as give him surplus for his investment. Majorly, the feasibility of a property depends on how much you put in the investment and how much surplus or value it gives you back. Feasibility attracts foreign buyers for a project.

Subject to this instance, Sachin Arora said, “The domestic and foreign investors are the core part. As there is always a need for residential spaces for domestic people within the country and foreign investors always look up investments which give him surplus to his/her money. The satire behind this, the Indian domestic buyers are still not convinced why commercial investment within the country is a boom.”

The political factor includes the government of the state or the country. No government has a magic solution which can resolve all the problems in one go. But a stable government has the potential to boost sentiments and attract foreign money. A stable government makes the investors comfortable with minor controversy, compact and major and strong agendas.

Let’s talk about in detail how a stable government benefits the real estate sector.

A stable government has a tremendous role in certain perspectives. To uplift the real estate sector, the government has to simplify the employment rate that leads to the migration of employees which circulate the demand for housing as well as commercial shops for them. Also the elevation of MNCs placement in a particular place, it encourages the need for office space which is also a rise to the realty sector.

To overseas companies in the desired region, either there has to be a certain disposition in the particular region or the government has to make a certain covenant to make it. Usually, an MNC looks for the geographical area that serves their requirements for their establishment in the particular region and in consideration of that the MNC anticipates in jobs production. Some of their prerequisite could be

- Availability of loans at a low-interest rate

- Availabilities of labors and employees

- Raw resources and transportations.

Another imperative that they seek is the geographical area where they can consider the soundness of storage and security of their raw and finished goods provided by the government.

A distinct outlook to escalate the real estate sector by the government could be the less inflation loan to the developer as well as buyers. Investors with low budgets often have a charm of the loan at low rate availability but if they couldn’t fix up the criteria, they end up mislaying their interest in real estate. Low reamortized rates attract developers to bring up their new projects in certain territories.

“Reforming stable economic criteria in the real estate sector is a steady process into which the government plays a vital role. In the year 2009, there was a gradual drop of the statistics in real estate shares in the share market which is now recovering and rising from the past few years.” said, Sachin Arora.

“If adduced with the present time election wave in Uttar Pradesh, real estate sector is eagerly looking forward to a stable government in spite of any charm of the formation of either X or Y government but an appeal that whosoever government comes up would be a stable government with a majority. In view of the fact that it will take precise decisions without any pressure and interference of any third party. Also, there would be a social security part that investors seek for with all law and order followed. If such a government comes up that will be a boost in the real estate sector.” Sachin Arora remarked.

Though refining a government into an unrushed move, there have been several changes that have been seen but due to this stability, there is an uplift in the real estate sector after the demonetisation, election and pandemic there is no drop but a rise in realty sector in India.

Not subjected to this, foreign money is also intended to be invested in the real estate of India due to the rise of a certain percent in Indian realty shares within a few years. If the things are subjected with the same frequency, sooner, there would be a rise in demand for Indian realty along with an increase in NRI investors.

More Stories

Excel CoolCoat Delivers Impressive Cooling of Buildings in Delhi: Roof Temperatures Drop by 19°C

Trailblazers Honoured at the House of Commons: Asian–UK Business Meet and Awards 2025 Celebrates Global Innovation and Bilateral Leadership

EcoEarth is Powering the Smart Home Revolution — Made for India