- The partnership aims to increase insurance penetration in rural India, Tier-II, and Tier-III cities

- With this collaboration, youth will receive IRDAI certification through the training process on Acuvisor mobile app and can earn INR 15,000 and more

New Delhi: With an aim to build a tech-enabled salesforce, National Skill Development Corporation International (NSDCI), subsidiary of the National Skill Development Corporation (NSDC) and Acuvisor Insurance Brokers (India) today announced their collaboration to skill India’s youth by training them to become Point of Sale Persons (POSP) through Acuvisor’s mobile application.

Acuvisor and NSDCI will work towards creating a skill ecosystem that will benefit 1 Lakh youth, across the country. NSDCI will leverage the application to train, certify, and effectively employ India’s youth in Tier-II and Tier-III cities, as well as rural geographies. Acuvisor’s partnership with NSDCI aims to provide India’s youth with an Insurance Regulatory and Development Authority of India (IRDAI) recognised certification, enabling them to access livelihood opportunities while increasing insurance penetration across India’s most uninsured markets. Besides, the partnership will also extend the trained individuals an opportunity to start their own ventures and embark on an entrepreneurial journey in the insurance sector.

The Acuvisor mobile application aims to create well-trained PoSPs, who will be allowed to sell only specifically designed insurance products. Introduced in 2016 by IRDAI, PoSPs are like insurance agents, who require minimum education of Class-X and 15 hours of training.

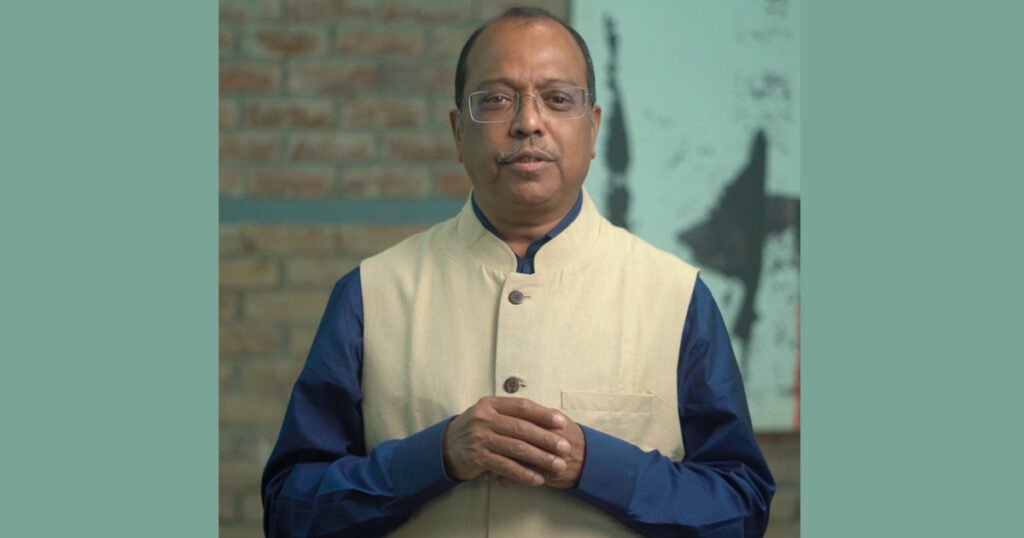

Commenting on the collaboration, Mr. Vasant Pandit, Mentor, Acuvisor said,we are delighted to announce that Acuvisor’s latest initiative with NSDCI will bring in a paradigm shift in the insurance sector in the country. The specially designed Acuvisor app will help youngsters (at least Class X pass) to undergo a 15 hour ‘in-house’ training course by insurance companies and insurance brokers that would certify them to sell tailored range of life insurances, health, and general insurance products. The insurance industry hasn’t been able to take advantage of the PoSP that was introduced in 2016. Our strategic partnership with NSDCI will allow us to train youth in the age groups 18-25 who have the potential to reach out to middle class families and tap an explored market in Tier 1, 2, 3 cities as well as rural areas. Acuvisor is also in talks with Madhya Pradesh’s Mahatma Gandhi State Institute of Rural Development (MGSIRD) to conduct the classes online through the Institute to reach youth in all Panchayats across the State and give rural youth experience in a new opportunity.

NSDCI will facilitate in creating awareness about the Acuvisor app across educational institutes and through its various promotional programs.

On the collaboration, Mr. Ved Mani Tiwari, COO, NSDC, said, insurance penetration is still low in India. Therefore, we want to train our potential workforce to leverage the opportunities in the sector and simultaneously propel India’s economic development by providing insurance benefits to the underserved markets. Our collaboration with Acuvisor will help bridge the skill gap existing in the industry. I am certain that with 15 hours of training and certification provided through the application, appropriate avenues will be built for India’s young talent. This collaboration holds immense potential in enhancing India’s insurance coverage while keeping pace with the changing dynamics of the sector. This alliance is also in line with the IRDAI mission of ‘insurance for all’ by 2047, part of government’s vision of India@100.

The Acuvisor mobile application is designed to help PoSPs to get trained, earn certification and then sell life, general and health insurance products. As prescribed by IRDAI, the application has a mandatory training course of 15 hours that is divided into multiple modules. The application will also help the candidates attain sales and marketing skills, will help them identify potential clients to sell insurance products of 34 insurance companies.

More Stories

Nickron Builds an Authentic Indian Sneaker Brand in a Market Dominated by Dupes

BBNG to Host Parivartan: A Two-Day Business Networking Conclave Aimed at Transforming Entrepreneurial Growth

Basil Launches Bento Quad+ India Collection, Celebrating Culture in Everyday Design